We are proficient in a wide array of leading online accounting platforms, ensuring that we can seamlessly integrate with your existing systems for immediate impact. Discover how our personalized solutions can simplify your accounting processes, reduce stress, and improve decision-making. The best Huntsville accountants secured the Best of Accounting award by obtaining at least a 50% Net Promoter® score indicating that they provide exceptionally high levels of client service to their Huntsville clients.

This account is sometimes referred to as the premium on common stock (The par value of common stock is recorded in a separate stockholder’s equity account.) The entry on the books of the company at the time the money is received in advance is a debit to Cash and a credit to Customer Deposits. It is deferred to the next accounting period by crediting a liability account such as Unearned Revenues. Land usually appears as the first item under the balance sheet heading of Property, Plant and Equipment. The book value of bonds payable is the combination of the accounts Bonds Payable and Discount on Bonds Payable or the combination of Bonds Payable and Premium on Bonds Payable. Also referred to as book value or carrying value; the cost of a plant asset minus the accumulated depreciation since the asset was acquired.

Bearden, Stroup & Associates, CPAs – Bookkeeping for Small Business

This connection between the income statement and balance sheet is important. Revenue accounts are credited when the company earns a fee (or sells merchandise) regardless of whether cash is received at the time. Again, the balance sheet and the accounting equation are in balance and all of the changes occurred on the asset/left/debit side of the accounting equation. Just as assets are on the left side (or debit side) of the accounting equation (the left side of the equal sign), the asset accounts in the general ledger have their balances on the left side. Marilyn cautions Joe that the balance sheet reports only the assets acquired (purchased) and only at the cost reported in the transaction. Long-term assets (such as buildings, equipment, and furnishings) are reported at their cost minus the amounts already sent to the income statement as Depreciation Expense.

A balance on the right side (credit side) of an account in the general ledger. The accounting term that means an entry will be made on the left side of an account. Invoice terms such as (a) net 30 days or (b) 2/10, n/30 signify that a sale was made on account and was not a cash sale.

Best Accountants in Huntsville, AL

- (Under the accrual basis of accounting, fees earned are reported in the time period in which they are earned and not in the period in which the company receives payment.)

- We scored Huntsville accountants on more than 25 variables across five categories, and analyzed the results to give you a hand-picked list of the best.

- The liability account involved in the $600 received on December 1 is Unearned Revenue (or Deferred Revenues, Customer Deposits, etc.).

- In managerial accounting, an accountant generates monthly or quarterly reports that a business’s management team can use to make decisions about how the business operates.

- In other words, the amount allocated to expense is not indicative of the economic value being consumed.

- Joe will be able to see at a glance the cash generated and used by his company’s operating activities, its investing activities, and its financing activities.

- The double-entry accounting system in use today was developed in medieval Europe, particularly in Venice, and is usually attributed to the Italian mathematician and Franciscan friar Luca Pacioli.

Find trusted accounting experts in Huntsville, AL! Below is the list of Top 20 Accounting Companies in Huntsville ranked based on company size, client reviews, services, and awards. It’s amazing that they actually take the time to lay out the business foundations and educate their clients. First time having to use a tax professional as accounting firms in huntsville I now have a overseas job. They are knowledgeable, helpful and handle all of our business and personal taxes. They pay special attention to helping business owners adjust their withholdings according to their changing financial situations.

Our goal is to provide a full-service bookkeeping solution that allows you to focus more on running your business and less on the numbers. This process helps prevent discrepancies and keeps your financial records in check. To maintain accurate records and ensure that all payments are accounted for, we meticulously reconcile invoices with corresponding payments.

- Careers in accounting may vastly differ by industry, department, and niche.

- The overarching objective of financial reporting, which includes the production and dissemination of financial information about the company in the form of financial statements, is to provide useful information to investors, creditors, and other interested parties.

- However, modern accounting as a profession has only been around since the early 19th century.

- Our goal is to provide a full-service bookkeeping solution that allows you to focus more on running your business and less on the numbers.

- This period of time might be a week, a month, three months, five weeks, or a year—Joe can choose whatever time period he deems most useful.

- The bottom line of the income statement when revenues and gains are less than the aggregate amount of cost of goods sold, operating expenses, losses, and income taxes (if the company is a regular corporation).

- For example, if a company receives $10,000 today to perform services in the next accounting period, the $10,000 is unearned in this accounting period.

What Are the Responsibilities of an Accountant?

Accounting is the process of recording, classifying and summarizing financial transactions. Comparability refers to the ability to make relevant comparisons between two or more companies in the same industry at a point in time. In addition, quantitative data are now supplemented with precise verbal descriptions of business goals and activities.

In England and Wales, chartered accountants of the ICAEW undergo annual training, and are bound by the ICAEW’s code of ethics and subject to its disciplinary procedures. In Scotland, chartered accountants of ICAS undergo Continuous Professional Development and abide by the ICAS code of ethics. Professional accounting qualifications include the chartered accountant designations and other qualifications including certificates and diplomas. A doctorate is required in order to pursue a career in accounting academia, for example, to work as a university professor in accounting.

Refine client and talent experiences to create growth opportunities for your staffing firm.

As a result, it should have a credit balance, and to increase its balance the account needs to be credited. Common stock is part of stockholders’ equity, which is on the right side of the accounting equation. In keeping with double entry, two (or more) accounts need to be involved. As with all rules, there are a few exceptions, but Marilyn’s reference to the accounting equation may help you to learn whether an account should be debited or credited. In accounting jargon, you credit the liability or the equity account. To increase the balance in a liability or stockholders’ equity account, you put more on the right side of the account.

Service Providers

Intercompany accounting concerns record keeping of transactions between companies that have common ownership such as a parent company and a partially or wholly owned subsidiary. Intercompany accounting focuses on the measurement, analysis and reporting of information between separate entities that are related, such as a parent company and its subsidiary companies. GAAP, in turn, arises from the wide agreement between accounting theory and practice, and changes over time to meet the needs of decision-makers. Financial accounting focuses on the reporting of an organization’s financial information to external users of the information, such as investors, potential investors and creditors.

When invoices are prepared and revenues are recorded, the software will also record the amount in the asset account Accounts Receivable. Even though his clients won’t be paying Direct Delivery until January 10, the accrual basis of accounting requires that the $4,000 be recorded as December revenues, since that is when the delivery work actually took place. Recording revenues when they are earned is the result of one of the basic accounting principles known as the revenue recognition principle. As you will see next, the term revenues is not the same as receipts, and the term expenses involves more than the checks written. Accounting software will generate sales invoices and accounting entries simultaneously, prepare statements for customers with no additional work, write checks, automatically update accounting records, etc. Joe wants to understand the financial statements and wants to keep on top of his new business.

Financial statements are usually audited by accounting firms, and are prepared in accordance with generally accepted accounting principles (GAAP). Management accounting focuses on the measurement, analysis and reporting of information for internal use by management to enhance business operations. By partnering with our CPA team, you gain access to top-tier tax advice and strategic business planning, positioning your business for success in a competitive marketplace. At Dimov Tax, our CPA team brings added value to your business with their extensive expertise in tax and business strategy. Our team assists with entity type selection, providing guidance tailored to the unique needs of your business to optimize tax benefits.

She states that accounting software will allow for the electronic recording, storing, and retrieval of those many transactions. His banker recommends Marilyn, an accountant who has helped many of the bank’s small business customers. He asks his banker to recommend a professional accountant who is also skilled in explaining accounting to someone without an accounting background. He assumes he will use some accounting software, but wants to meet with a professional accountant before making his selection. Joe is a hard worker and a smart man, but admits he is not comfortable with matters of accounting. In this explanation of accounting basics, and throughout all of the free materials and the PRO materials, we will often omit some accounting details and complexities in order to present clear and concise explanations.

You will become familiar with accounting debits and credits as we show you how to record transactions. This explanation of accounting basics will introduce you to some basic accounting principles, accounting concepts, and accounting terminology. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Due to its importance, accountants enjoy strong pay, steady demand, and career flexibility across nearly any industry. Regulators also rely on accountants for critical functions such as providing auditors’ opinions on companies’ annual 10-K filings.

Financial accounts have two different sets of rules they can choose to follow. Financial accountants typically operate in a cyclical environment with the same steps happening in order and repeating every reporting period. Tax accountants overseeing returns in the United States rely on guidance from the Internal Revenue Service. Careers in accounting may vastly differ by industry, department, and niche.

The firm also guides clients in making decisions about tax planning and preparation. Aside from supporting financial issues, its team of professionals also delivers up-to-date record-keeping and reporting. The company also helps its clients save thousands of dollars through new laws, such as the Alabama Full Employment Credit Act. It caters to individuals, contractors, healthcare professionals, and service-based businesses.

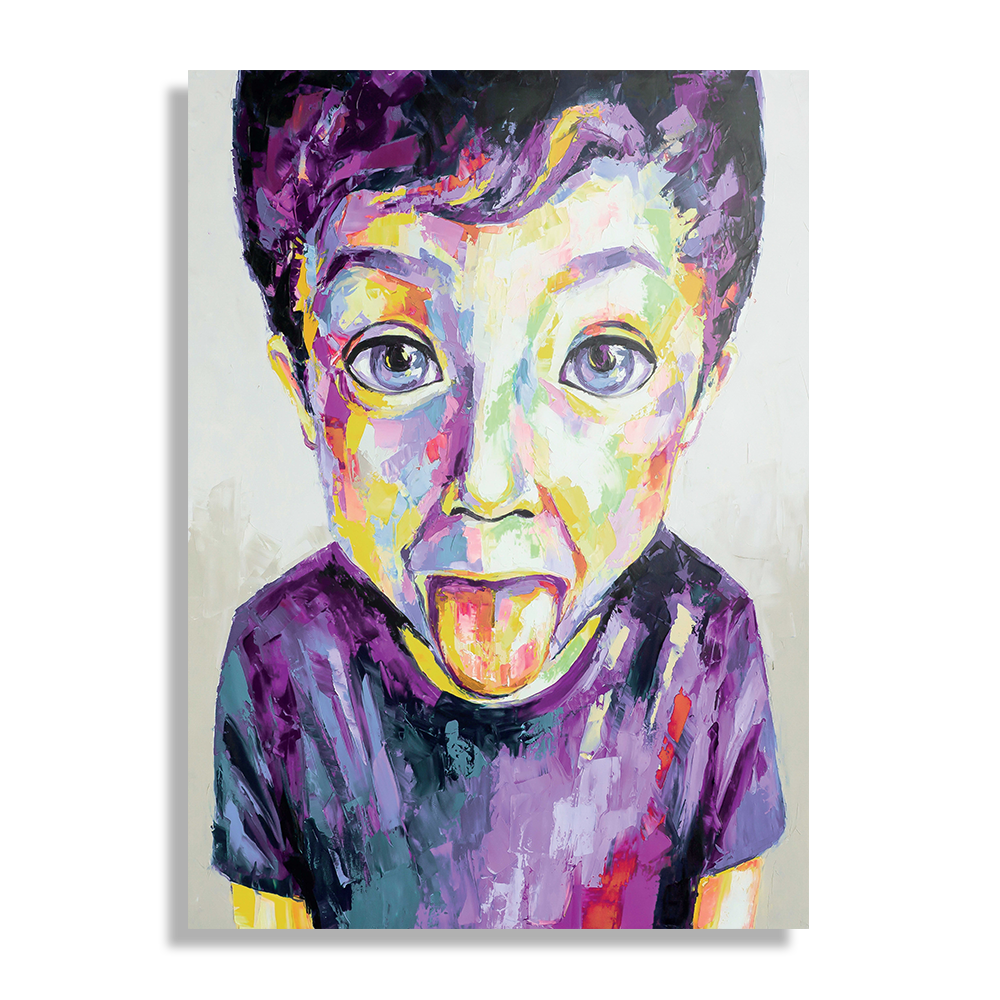

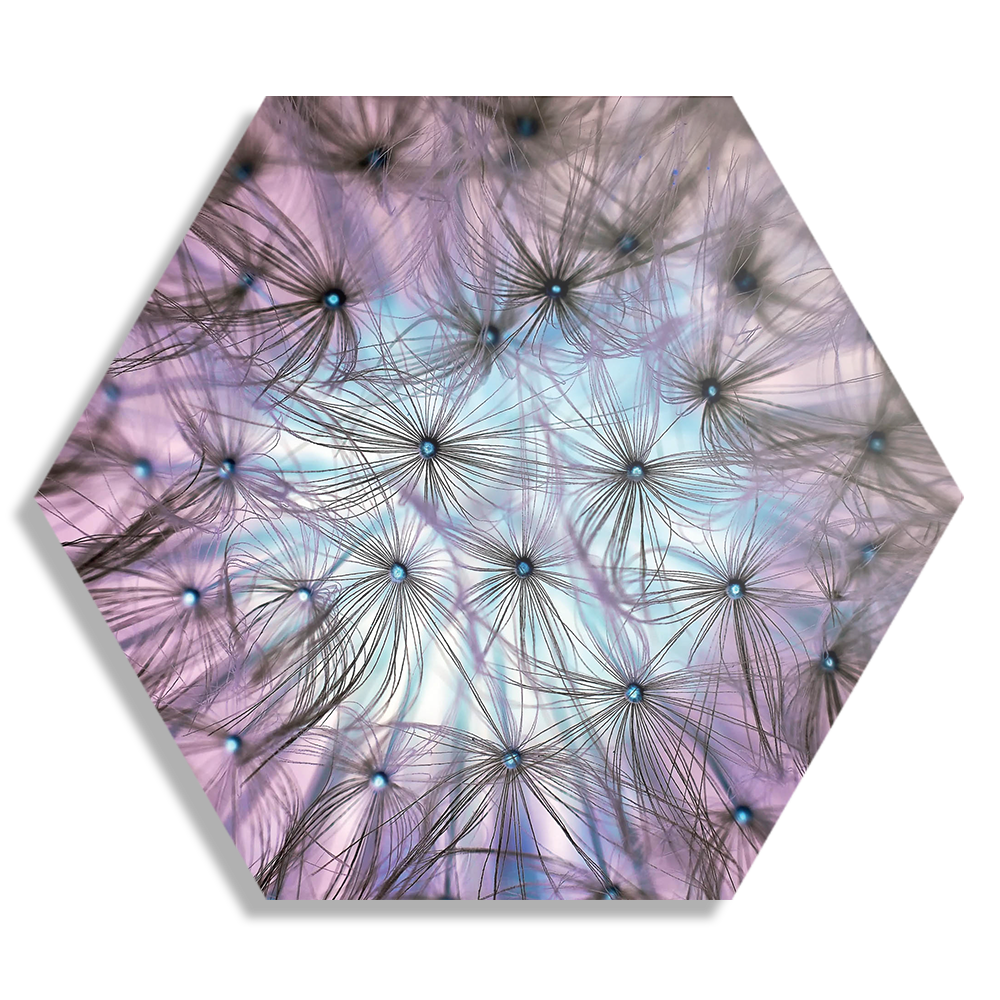

Modern

Modern

Scandinavisch

Scandinavisch

Plexiglas

Plexiglas

Forex

Forex

Textielposter

Textielposter

Wandkleed

Wandkleed